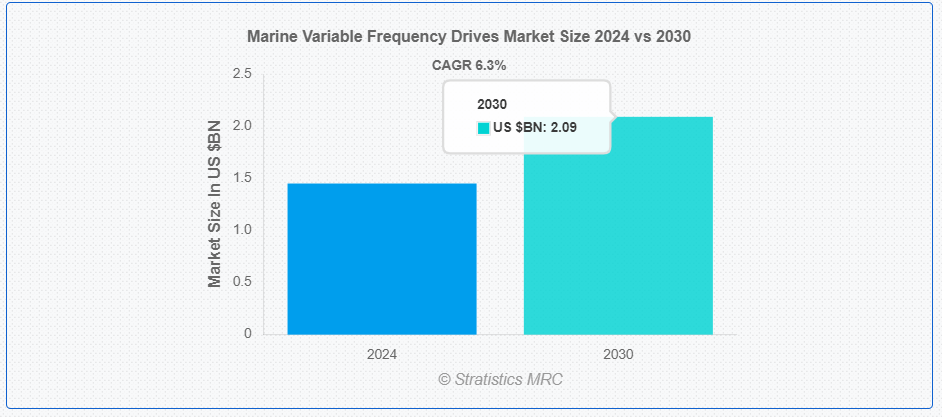

글로벌 해양 가변 주파수 드라이브(VFD) 시장은 2024년에 14억 5천만 달러로 평가되며, 2030년까지 20억 9천만 달러에 이를 것으로 예상되며, 이 기간 동안 연평균 성장률(CAGR)은 6.3%에 이를 것으로 보입니다. 해양 VFD는 선박의 전기 모터에 공급되는 전기의 주파수와 전압을 조절하여 속도와 토크를 조절하는 장치로, 부드러운 가속 및 감속을 통해 기계적 스트레스를 줄이고 장비의 수명을 연장하며 어려운 해양 환경에서 전반적인 성능을 향상시킵니다. 이러한 통합은 해양 부문에서 지속 가능성을 장려하고 환경 규제를 준수하는 데 필수적입니다. 해양 VFD 시장의 주요 동인은 해상 운송 수요 증가입니다. 국제 무역이 계속 성장함에 따라 효과적이고 신뢰할 수 있는 운송 솔루션에 대한 필요성이 증가하고 있으며, 이에 따라 정밀한 조종 및 속도 제어가 필요한 상선 및 군함의 수가 증가하고 있습니다. 그러나 해양 VFD의 초기 비용이 상당히 높아 시장 확장을 제약하는 요소로 작용하고 있습니다. 정부의 규제와 기준은 해양 VFD 시장 구조에 큰 영향을 미치며, 이는 혁신을 촉진하고 최신 환경 요구 사항을 충족하기 위해 VFD 시스템에 대한 투자를 장려합니다. 해양 VFD의 설치와 유지보수는 복잡성으로 인해 어려움을 겪고 있으며, 이는 시장 확장을 저해할 수 있는 요인으로 작용합니다. COVID-19 팬데믹은 해양 VFD 시장에도 영향을 미쳤고, 글로벌 공급망의 중단과 경제 활동 감소로 인해 신조선과 해양 장비의 수요가 감소했습니다. 그러나 팬데믹 회복 노력과 에너지 효율성 및 배출 감소에 대한 강조로 인해 VFD 수요가 다시 증가하고 있습니다. AC 드라이브 부문은 해양 응용 분야에서 속도와 토크를 조절하는 데 필수적이어서 가장 큰 시장 점유율을 차지할 것으로 예상됩니다. 또한, 해양 시스템의 안전성과 효율성을 높이기 위한 첨단 기술의 필요성이 증가함에 따라 해양 및 방위 부문이 가장 높은 CAGR을 기록할 것으로 보입니다. 북미 지역은 엄격한 환경 규제와 해양 부문의 성장으로 인해 가장 큰 시장 점유율을 차지할 것으로 예상되며, 아시아 태평양 지역은 높은 CAGR을 기록할 것으로 전망됩니다. 해양 VFD 시장의 주요 업체로는 ABB, Siemens, Danfoss, Rockwell Automation, Mitsubishi Electric 등이 있으며, 이들은 지속적인 혁신과 제품 출시를 통해 시장에서의 경쟁력을 높이고 있습니다. 이 보고서는 지역별 및 국가별 시장 점유율 평가, 신규 진입자를 위한 전략적 권고, 시장 동향, 경쟁 환경 분석 등을 포함하고 있습니다. |

The global marine variable frequency drives market is valued at $1.45 billion in 2024 and is expected to reach $2.09 billion by 2030, at a CAGR of 6.3% during the forecast period, according to Strategist MRC. A marine variable frequency drive (VFD) is a specialized device that changes the frequency and voltage of the electricity supplied to a ship’s electric motors to regulate speed and torque. By facilitating smooth acceleration and deceleration, marine VFDs reduce mechanical stress, extend equipment life, and improve overall performance in challenging marine conditions. This integration is essential to encourage sustainability in the maritime sector and comply with environmental regulations.

According to the IEA, the international shipping industry accounted for 2% of global energy-related CO2 emissions in 2019. According to the United Nations Conference on Trade and Development (UNCTAD), international seaborne trade increased by 4% in 2017 due to the growth of the global economy.

Market dynamics:

Drivers:

Increasing demand for maritime transportation

One of the main factors driving the market is the increasing demand for maritime transportation. As international trade continues to grow, the need for effective and reliable transportation solutions is increasing, resulting in a growing number of merchant and naval vessels that require sophisticated propulsion and control systems. VFDs are essential in these systems because they accurately control the ship’s direction, speed, and maneuvering. The use of VFDs in a variety of marine applications, such as propulsion systems, deck machinery, and cargo handling, is only increasing as the need for maritime transportation grows.

Restraints:

High initial cost

The use of marine variable frequency drives (VFDs) in the marine industry is significantly constrained by their high initial price. The initial cost to purchase and install a VFD system can be high, especially when retrofitting an existing vessel, as it entails additional costs for labor and engineering changes. Integrating VFD technology requires a percentage of the construction budget for a new structure, further increasing costs. The high upfront cost of VFDs is a major barrier to market expansion, despite the long-term energy savings and operational benefits.

Opportunities:

Government regulations and standards

Government regulations and guidelines have a significant impact on the structure of the marine variable frequency drive (VFD) market. Regulatory bodies such as the International Maritime Organization (IMO) have set stringent rules to improve energy efficiency and reduce greenhouse gas emissions. Ship owners are required to implement sophisticated technologies such as VFDs to meet standards such as the Carbon Intensity Index (CII) and the Energy Efficiency Design Index (EEDI). As such, these regulations encourage investment in VFD systems to spur innovation and ensure that ships meet the latest operational and environmental requirements while advancing sustainability in the maritime sector.

Threats:

Installation and maintenance complexity

The installation and maintenance of marine variable frequency drives (VFDs) in the marine industry can be challenging due to their complexity. Because VFDs are complex systems that require precise electrical connections and safety compliance, they require qualified professionals to install them. The process is further complicated by the fact that retrofitting an existing vessel often requires significant changes to the structural and electrical systems. Shipowners may be reluctant to adopt VFD technology due to the need for specific expertise and the potential for downtime during installation or maintenance, which could hinder the expansion of the market as a whole.

COVID-19 impact

The marine variable frequency drive (VFD) business has been significantly impacted by the COVID-19 pandemic. Disruptions to global supply chains and a downturn in economic activity have led to a decline in the market for new ships and marine equipment. However, as the pandemic has spread and recovery efforts have progressed, the need for VFDs has begun to grow. The growing emphasis on energy efficiency and emission reduction, coupled with the need for modernization and retrofitting of existing fleets, has led to a resurgence in the VFD market.

The AC drives segment is expected to be the largest during the forecast period.

The AC drives segment is estimated to be the largest as it is capable of regulating electric motor speed and torque, which is essential for several onboard systems such as propulsion, pumps, and ventilation, and is widely utilized in marine applications. Their use results in significant energy savings, resulting in improved operational efficiency and reduced fuel usage. Increasing regulatory constraints on sustainability and energy efficiency in the marine industry are driving the need for AC drives in modern marine operations.

The naval & defense sector is expected to witness the highest CAGR during the forecast period.

The naval & defense sector is expected to witness the highest CAGR during the forecast period, owing to the growing need for cutting-edge technologies that increase operational safety and efficiency. In marine systems, including propulsion, pumps, and HVAC, VFDs are essential for managing torque and speed. Government regulations and the emphasis on updating ships with electric and hybrid propulsion systems to comply with environmental regulations and enhance mission readiness are further fueling the adoption of VFD technology.

Highest share by region:

North America is expected to account for the largest market share during the forecast period, owing to stringent environmental regulations enforced by the International Maritime Organization (IMO) and the Environmental Protection Agency (EPA), which are promoting the reduction of emissions and increase in energy efficiency. Energy-efficient propulsion systems are in great demand owing to the region’s thriving marine sector, including offshore oil exploration, naval operations, and commercial vessels. Furthermore, advancements in digitalization and automation in marine technology are encouraging the use of VFDs to improve operational performance and sustainability.

Region with the highest CAGR:

Asia Pacific is expected to register the highest CAGR during the forecast period. The strong shipbuilding industry, especially in countries such as China, South Korea, and Japan, is significantly increasing the need for VFDs to improve energy management and operational efficiency. The increasing emphasis on energy conservation and compliance with strict environmental standards is further encouraging the use of VFD technology in maritime operations. The rise of the offshore oil exploration industry and maritime trade is contributing to the expansion of the market, as shipowners are looking for cutting-edge technologies to maximize the performance of their vessels and reduce fuel consumption.

Key players in the market

Some of the key players profiled in the marine variable frequency drive market include ABB, Siemens, Danfoss, Rockwell Automation, Emerson Electric, Mitsubishi Electric, Yaskawa Electric, Parker Hannifin, Schneider Electric, WEG, Toshiba, Nidec Corporation, Fuji Electric, Roysomer, Inductrol, GE Industrial Solutions, Rexroth Bosch Group, SKF, Omron, and Toshiba Machinery.

Key developments:

In May 2023, ABB unveiled the Dynafin™ propulsion system, inspired by the dynamic movement of a whale’s tail. This innovative system aims to improve efficiency in the marine industry.

In March 2023, Siemens launched the SINAMICS Perfect Harmony GH180, a marine-specific VFD that provides optimized energy efficiency and control for large propulsion systems on commercial vessels.

In July 2022, Rockwell Automation launched a new series of marine-certified Allen-Bradley PowerFlex VFDs focused on durability and energy savings for shipboard propulsion and HVAC systems.

In October 2021, Danfoss launched VACON® NXP liquid cooled drives targeted at the marine sector for energy-efficient control of high-performance propulsion and thruster systems.

In February 2021, Mitsubishi Electric launched the next generation FR-F800 VFD, designed for marine propulsion and pump systems, focusing on energy savings and reliability in harsh marine environments.

Application types

– AC drives

– DC drives

– Servo drives

– Other types

Supported power ratings:

– Low power (up to 100 kW)

– Medium power (100 kW to 500 kW)

– High power (500 kW and above)

Supported technologies

– Silicon carbide (SiC)

– Gallium nitride (GaN)

– Silicon (Si)

– Other technologies

Applications

– Pump systems

– Fans and blowers

– Propulsion systems

– Compressors

– Cranes and hoists

– Deck machinery

– Heating, ventilation, and air conditioning (HVAC)

– Steering

– Scrubbers

– Shaft generators

– Power electronics

– Other applications

For end users:

– Commercial shipping

– Naval and defense

– Offshore vessels

– Fishing vessels

– Recreational boats

– Other end users

Supported Regions

– North America

o United States

o Canada

o Mexico

– Europe

o Germany

o United Kingdom

o Italy

o France

o Spain

o Rest of Europe

– Asia Pacific

o Japan

o China

o India

o Australia

o New Zealand

o South Korea

o Other Asia Pacific

– South America

o Argentina

o Brazil

o Chile

o Other South America

– Middle East and Africa

o Saudi Arabia

o United Arab Emirates

o Qatar

o South Africa

o Rest of Middle East & Africa

Report highlights include

– Market share assessments for regional and country-specific segments

– Strategic recommendations for new entrants

– Covers market data for 2022, 2023, 2024, 2026, and 2030

– Market trends (drivers, restraints, opportunities, threats, challenges, investment opportunities, and recommendations)

– Strategic recommendations for key business segments based on market estimates

– Competitive landscape mapping of key common trends

– Company profiling, including detailed strategic, financial, and recent developments

– Supply chain trends mapping the latest technological advancements

1 요약

2 서문

2.1 요약

2.2 스테이크 홀더

2.3 연구 범위

2.4 연구 방법론

2.4.1 데이터 마이닝

2.4.2 데이터 분석

2.4.3 데이터 검증

2.4.4 연구 접근 방식

2.5 연구 출처

2.5.1 1차 연구 출처

2.5.2 보조 연구 출처

2.5.3 가정

3 시장 동향 분석

3.1 소개

3.2 동인

3.3 제약

3.4 기회

3.5 위협

3.6 기술 분석

3.7 애플리케이션 분석

3.8 최종 사용자 분석

3.9 신흥 시장

3.10 코로나19의 영향

4 포터의 다섯 가지 힘 분석

4.1 공급자의 협상력

4.2 구매자의 협상력

4.3 대체재의 위협

4.4 신규 진입자의 위협

4.5 경쟁 경쟁

5 유형별 글로벌 해양 가변 주파수 드라이브 시장

5.1 소개

5.2 AC 드라이브

5.3 DC 드라이브

5.4 서보 드라이브

5.5 기타 유형

6 전력 등급 별 글로벌 해양 가변 주파수 드라이브 시장

6.1 소개

6.2 저전력 (최대 100kW)

6.3 중간 전력 (100kW ~ 500kW)

6.4 고전력 (500kW 이상)

7 기술별 글로벌 해양 가변 주파수 드라이브 시장

7.1 소개

7.2 실리콘 카바이드 (SiC)

7.3 질화 갈륨 (GaN)

7.4 실리콘 (Si)

7.5 기타 기술

8 글로벌 해양 가변 주파수 드라이브 시장, 애플리케이션 별

8.1 소개

8.2 펌프 시스템

8.3 팬 및 송풍기

8.4 추진 시스템

8.5 압축기

8.6 크레인 및 호이스트

8.7 데크 기계

8.8 난방, 환기 및 공조(HVAC)

8.9 스티어링

8.10 스크러버

8.11 샤프트 발전기

8.12 전력 전자

8.13 기타 응용 분야

9 최종 사용자 별 글로벌 해양 가변 주파수 드라이브 시장

9.1 소개

9.2 상업용 선박

9.3 해군 및 방위

9.4 해양 선박

9.5 어선

9.6 레저 보트

9.7 기타 최종 사용자

10 지역별 글로벌 해양 가변 주파수 드라이브 시장

10.1 소개

10.2 북미

10.2.1 미국

10.2.2 캐나다

10.2.3 멕시코

10.3 유럽

10.3.1 독일

10.3.2 영국

10.3.3 이탈리아

10.3.4 프랑스

10.3.5 스페인

10.3.6 기타 유럽

10.4 아시아 태평양

10.4.1 일본

10.4.2 중국

10.4.3 인도

10.4.4 호주

10.4.5 뉴질랜드

10.4.6 대한민국

10.4.7 기타 아시아 태평양 지역

10.5 남미

10.5.1 아르헨티나

10.5.2 브라질

10.5.3 칠레

10.5.4 남미의 나머지 지역

10.6 중동 및 아프리카

10.6.1 사우디 아라비아

10.6.2 아랍에미리트

10.6.3 카타르

10.6.4 남아프리카 공화국

10.6.5 중동 및 아프리카의 나머지 지역

11 주요 개발 사항

11.1 계약, 파트너십, 협업 및 합작 투자

11.2 인수 및 합병

11.3 신제품 출시

11.4 확장

11.5 기타 주요 전략

12 회사 프로파일링

- 글로벌 음성 녹음기 시장 성장 전망 2025-2031 : 시장규모는 연평균 4.8% 성장 예측

- 글로벌 상업용 항공기 창문 및 윈드실드 시장 성장 전망 2025-2031 : 시장규모는 연평균 4.7% 성장 예측

- 글로벌 평판형 막 모듈 시장 성장 전망 2025-2031 : 시장규모는 연평균 6.2% 성장 예측

- 글로벌 전기차용 고체 구리 버스바 시장 성장 전망 2025-2031

- 글로벌 가상 사설망(VPN) 라우터 시장 성장 전망 2025-2031 : 시장규모는 연평균 13.5% 성장 예측

- 세계의 리튬 배터리용 건조 장비시장 2025년 (배치형, 인라인형) : 글로벌 및 한국시장 규모 포함

- 글로벌 알리사이클릭 머스크 시장 성장 전망 2025-2031 : 시장규모는 연평균 6.0% 성장 예측

- 전지형 차량(ATV) 글로벌 시장 인사이트 2025년, 제조업체, 지역, 기술, 응용 분야별 분석 및 2030년까지의 전망

- 글로벌 합성 및 천연 제올라이트 시장 성장 2025-2031 : 시장규모는 연평균 5.2% 성장 예측

- 글로벌 언더 캐비닛 조명 시장 성장 전망 2025-2031 : 시장규모는 연평균 8.6% 성장 예측

- 글로벌 로드 밸런서 시장 : 유형별 (로컬로드 밸런서, 글로벌로드 밸런서), 구성 요소 (하드웨어, 소프트웨어, 서비스), 배포 모드 (온 프레미스, 클라우드 기반), 기업 규모 (중소기업, 대기업), 최종 사용 산업 (BFSI, IT 및 통신, 소매, 정부, 제조, 미디어 및 엔터테인먼트, 의료, 기타) 및 지역별 2024-2032 년까지

- 글로벌 크레이프 마스킹 테이프 시장 성장 전망 2025-2031 : 시장규모는 연평균 5.4% 성장 예측

- https://www.globalresearch.kr/report/south-korea-unsaturated-polyester-resins-bna25jl036

- https://www.marketreport.kr/report/global-mv-switchgears-motor-control-mr-ku03982

- https://www.globalresearch.co.kr/report/low-voltage-electric-motor-market-imarc25ma1079

- https://www.marketreport.kr/report/global-aircraft-door-latches-mr-ku08379

- https://www.marketreport.co.kr/report/global-dental-acrylic-materials-mr-gifr14052